9th August 2023

A poor mans covered call on NIO

Welcome to the first blog post here on pmcc-calculator.com.

I’m going to jump right into this first blog post about how to structure a poor mans covered call. Always remember, this is not financial advise, and your capital is always as risk 🙂

Your long call should ideally have around 80% delta, so anything around 0.75 - 0.85 is a good target.

This long call should also have plenty of days until expiration (DTE), around 90+ days here is a good guideline.

For example, buying the NIO 19th Jan 2024 $10 Call has 164 DTE, and a Delta of 0.817, and costs around $4.45 so in total, it would be $445, with NIO currently trading at $13.35, this is only 33% of the capital required to purchase 100 shares.

Now we’ve purchased the call, we can sell a covered call against our LEAP, but we need to be careful, we need to make sure that if NIO’s stock price goes above our short call, we still profit from the trade.

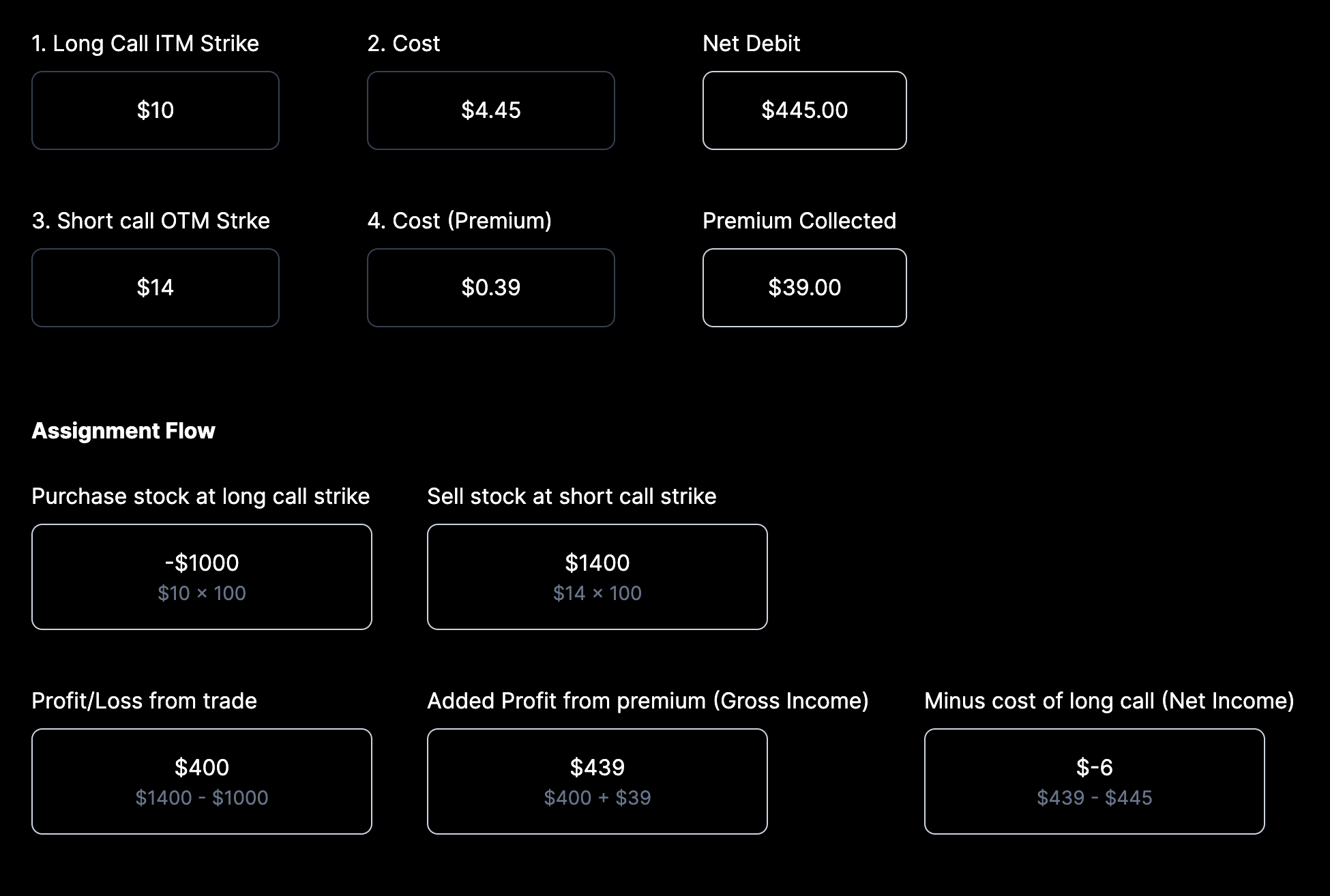

We can do this by using our calculator:

Here you can see our Long Call (LEAP), the cost, and the debit. Followed by the short call (Covered Call), the cost (Premium). Here I’ve chosen the 18th August 23 $14 Strike (10 DTE) giving me a premium of $39

However, this trade isn’t optimal, you can see that our Net Income, if assigned, would actually lose money, $6 dollars in fact.

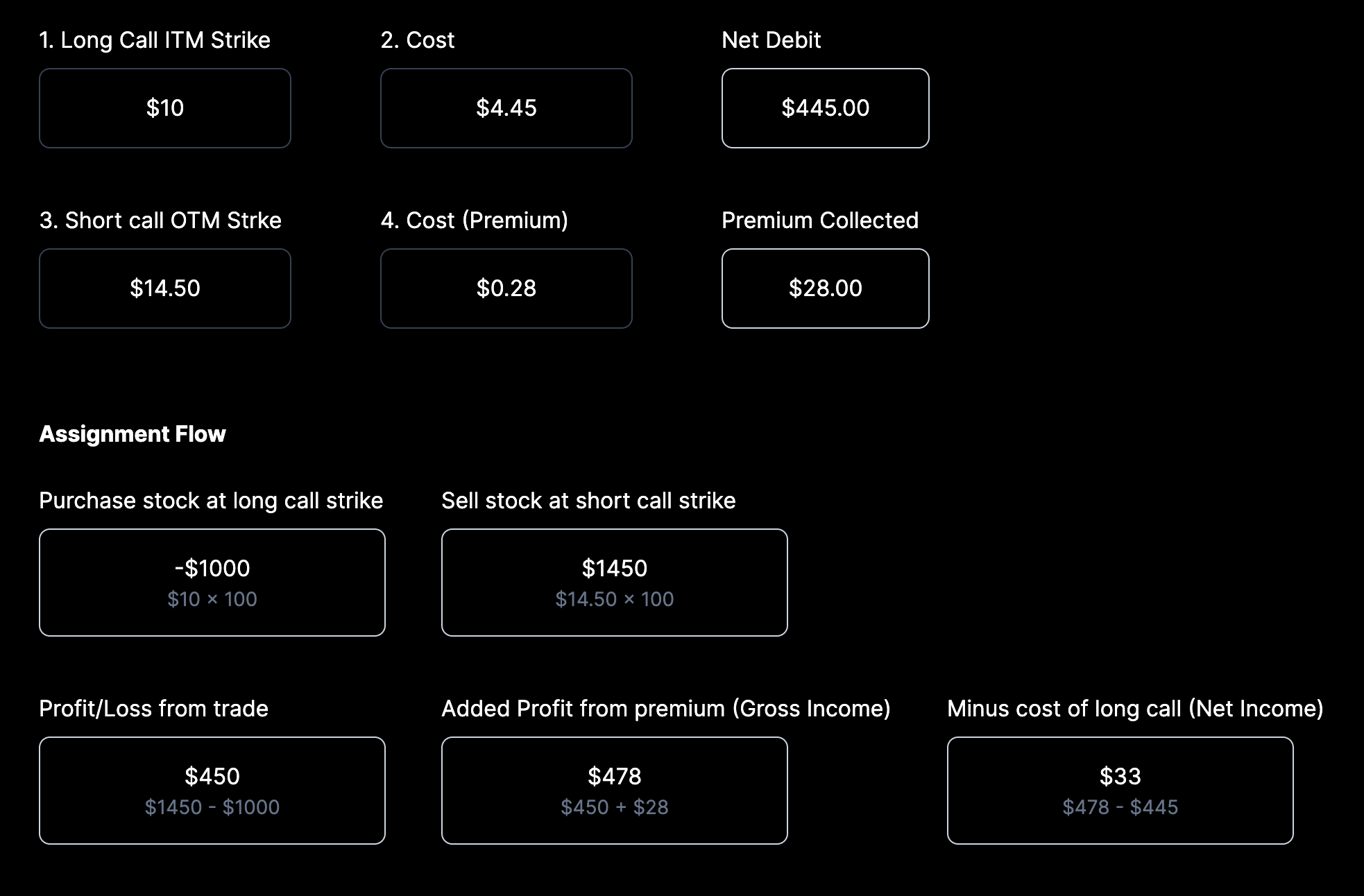

To combat this, we would need to increase our income, if I move the short call strike up to $14.50, I lose out on some premium (0.11 to be exact, 0.39 - 0.28), but my Net Income is now positive, and I stand to gain $33 if NIO climbs to $14.50.

It’s also worth noting that the original $14 Strike had 0.375 Delta, where as the $14.50 had 0.284. So we have more chance of our short call option not expiring in the money (ITM).

I’ll follow up on this trade and document it’s journey. Stay tuned.

Previous Article