31st August 2023

What is a poor mans covered call?

A poor mans covered call, or PMCC for short, is an options strategy that simulates the position of a covered call.

In a covered call strategy, you own 100 shares of the underlying stock and sell a call option to generate income. If you are assigned, you shares are called away and sold at the strike price of your call option.

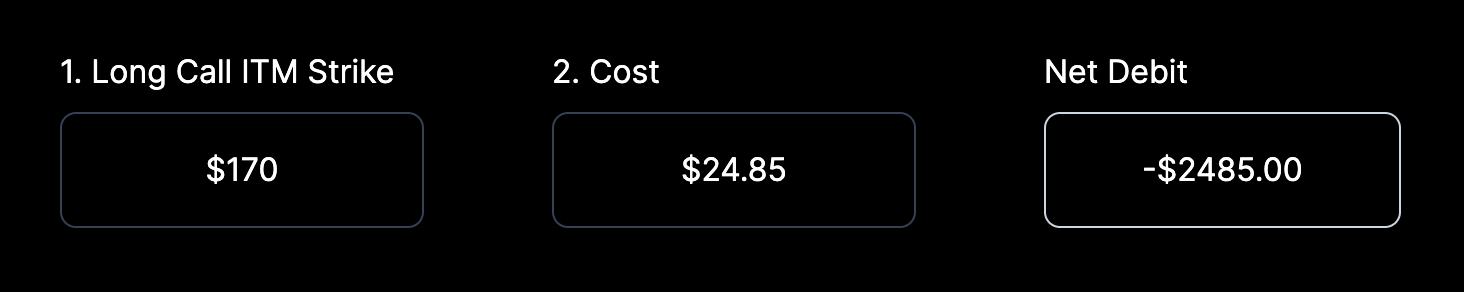

In a poor mans covered call strategy, you do not need the 100 shares, the benefits of a poor man's covered call is that you only need a fraction of the capital required to purchase a long call which will act as your 100 shares of stock, for example, looking at AAPL, currently trading at $187 as of 31st August 2023, you could buy the $170 Jan 19th 2024 Call for $24.85. So a total of $2485.

If you wanted 100 Shares of AAPL you would have to fork out over $18,700!

The Long Call

For a poor mans covered call, you buy a deep in the money long call option, This call option should have a reasonable amount of time until expiration (DTE), around 90+ days is a good benchmark. The delta of the call option should be around 0.7 or higher.

Options with a high delta are deep in the money and have less extrinsic value, making them closer to synthetic long stock.

The Short Call

Now you have your long call which acts as a surrogate for 100 shares of your chosen underlying, you can now sell a covered call against it and collect the premium.

You can choose whatever DTE you want for your short call, but a good recommendation is 30-45 days.

What happens if I get assigned?

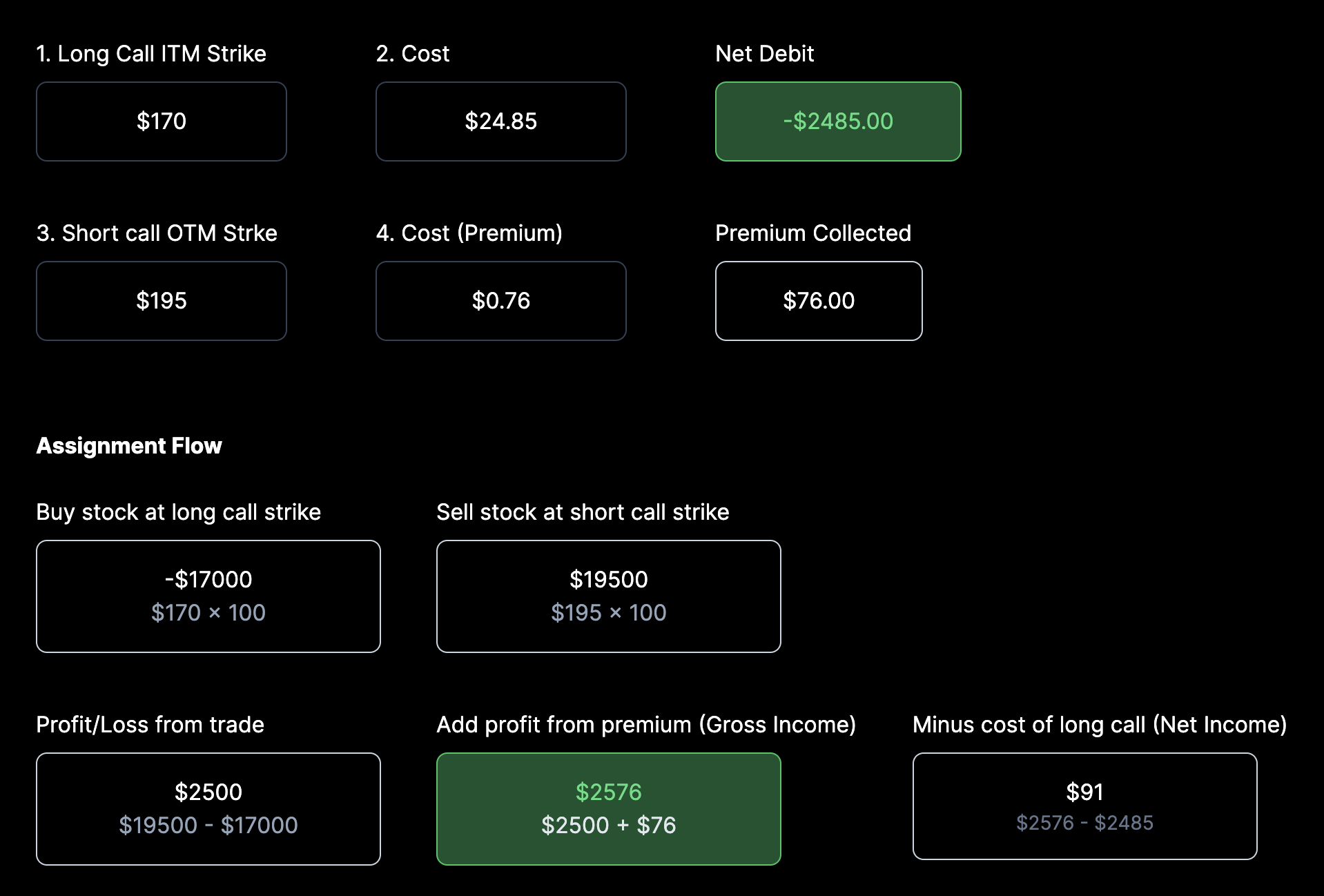

If your short call option expires in the money you will be assigned. This means you will have to sell 100 shares of your stock at your short call strike. However, because you have your long call, you can exercise it and buy 100 shares at the strike price of your long call.

It is important to understand that profit from the sale of the stock at the short strike, plus the premium received, is more than the cost of the initial long call, other wise, you will end up in the red! 🔴

To visualise this, I can use the calculator:

Step 1 - I enter the Long Call Strike and the Cost

Step 2 - I enter the Short Call Strike and the Premium.

Note: Now I already know that I have paid $2485 for the long call, so I want to make that back if I get assigned, this would mean AAPL would need to climb by $24.85 to $194.85 to break even, however, this is without receiving any premium.

If I go for the 8th Sept 23 $195 I can received $0.25 in premium ($25).

If I go for the 15th Sept 23 $195 I can received $0.76 in premium ($76).

Both trades ensure that if AAPL does climb to 195, I still make a profit.

Let's work out the annualized return of this trade:

| Implied Risk: | Long Call Net Debit $2485 - Short Call premium $76 = $2409 |

| Trade Duration: | 16 Days |

| Calculation: | (($76 / $2485) * (365 / 16 days) * 100) = 69.76% annualized return |